Catalogues have long been considered a convenient and accessible way to shop for a wide range of products. However, there are many misconceptions surrounding the use of catalogues for individuals with bad credit. These myths often deter people from considering catalogues as a viable credit option, preventing them from accessing the benefits these credit sources can offer. In this comprehensive guide, we will debunk common myths and shed light on the reality of using catalogues for bad credit.

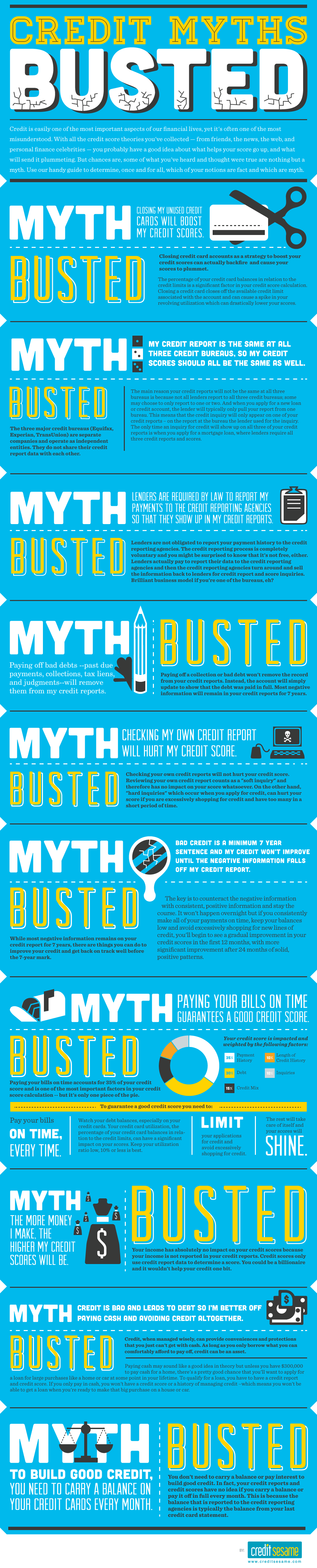

Myth 1: Catalogues are Only for Those with Good Credit

The reality is that catalogues cater to a diverse audience, including individuals with bad credit. While it’s true that some catalogues may have stringent credit requirements, many others are specifically designed to provide credit options to those with less-than-perfect credit scores. These catalogues understand the challenges that individuals with bad credit face and offer credit opportunities that can be instrumental in rebuilding credit.

Myth 2: Catalogue Credit is Expensive and Predatory

There is a common misconception that catalogue credit comes with exorbitant interest rates and predatory practices. While it’s true that some catalogues may have higher interest rates compared to traditional lenders, responsible credit usage can help mitigate costs. Moreover, reputable catalogues are transparent about their credit terms and conditions, allowing customers to make informed decisions.

Myth 3: Catalogues are Not Effective for Rebuilding Credit

Contrary to this myth, using catalogues can indeed contribute to credit score improvement. Many catalogues report customer payment behaviour to credit bureaus, meaning that responsible credit usage can positively impact credit scores over time. Regular and timely payments with catalogues can demonstrate creditworthiness and help individuals with bad credit rebuild their financial standing.

Myth 4: Catalogue Credit Limit is Too Low

Some individuals believe that catalogue credit limits are inadequate for meaningful purchases. However, credit limits can vary among different catalogues. While initial credit limits may be lower for individuals with bad credit, responsible credit usage and timely payments can lead to potential credit limit increases over time.

Myth 5: Catalogue Shopping is Limited and Low-Quality

Another myth surrounding catalogues is that they offer limited and low-quality products. In reality, reputable catalogues partner with well-known brands and offer a wide selection of products, ranging from fashion and electronics to household items. Customers have access to a diverse product range, catering to various preferences and needs.

Myth 6: Catalogues Have Hidden Fees and Charges

It’s a common misconception that catalogues have hidden fees and charges, making them costly for consumers. While some catalogues may have additional fees, reputable ones are transparent about their credit terms and ensure that customers understand all associated costs. Reading and understanding the credit terms can help avoid unexpected charges.

Conclusion

Catalogues can be a valuable credit option for individuals with bad credit, offering accessible credit, diverse product selections, and the potential for credit score improvement. It’s essential to differentiate between myths and reality when considering catalogue options. Responsible credit usage, timely payments, and informed decision-making can maximize the benefits of using catalogues for bad credit users. By debunking these myths and understanding the true potential of catalogue credit, individuals can take steps towards improving their credit scores and achieving greater financial stability. Remember to leverage catalogue credit responsibly and use it as a stepping stone towards a stronger credit profile and better financial future.