Credit challenges can be a significant barrier when trying to secure catalogues or other forms of credit in the UK. Bad credit can make it difficult to access the products and services you need, and can leave you feeling frustrated and financially constrained. However, it is important to know that there are still options available to those with less than perfect credit scores.

Despite the challenges posed by bad credit, there are strategies that can help you secure catalogues easily in the UK. By understanding your credit situation and taking steps to improve it, you can increase your chances of getting approved for a catalogue account. In the following sections, we will discuss some key takeaways to help you navigate the world of catalogues with bad credit.

key Takeaways

1. Catalogue companies in the UK offer options for individuals with bad credit, allowing them to still access products and improve their credit rating.

2. To secure a catalogue easily despite bad credit, individuals can apply for a “pay monthly” catalogue and make regular, on-time payments to demonstrate financial responsibility.

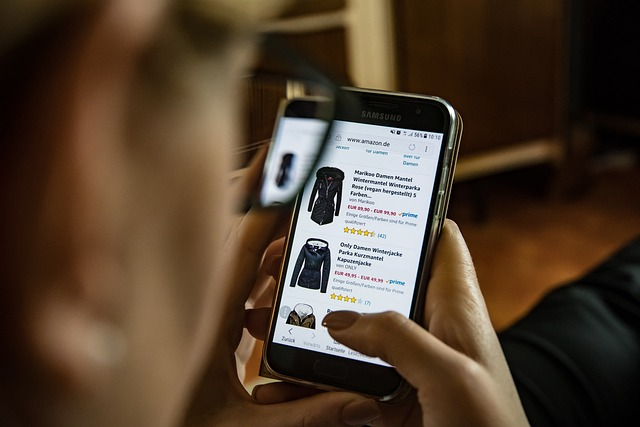

3. Catalogues offer a range of products, from clothing to appliances, making it easy for individuals to find items they need or want without having to pay upfront.

4. By using a catalogue responsibly and making timely payments, individuals can gradually improve their credit score over time, leading to greater financial opportunities in the future.

5. It is important for individuals to understand the terms and conditions of their catalogue agreement, including interest rates and repayment schedules, to ensure they can manage their finances effectively and avoid falling into debt.

Can I Secure Catalogues Easily Despite Bad Credit in the UK?

Understanding Credit Challenges

Having bad credit can be a major obstacle when it comes to securing catalogues in the UK. Your credit score is a crucial factor that determines your creditworthiness in the eyes of lenders. A poor credit history can lead to rejections when applying for catalogues, making it difficult to shop on credit.

How Bad Credit Affects Catalogue Applications

When you have bad credit, catalogue companies may see you as a higher risk borrower. This can result in higher interest rates, lower credit limits, or even outright rejection of your application. It’s important to be aware of how your credit score impacts your ability to secure catalogues, so you can take steps to improve it.

Securing Catalogues Despite Bad Credit

Despite having bad credit, there are still ways to secure catalogues in the UK. One option is to look for catalogues that specialize in catering to individuals with poor credit. These companies may offer products specifically designed for those with less-than-perfect credit histories.

Improving Your Credit Score

Another strategy is to work on improving your credit score. This can be done by making timely payments on your existing debts, reducing your credit utilization ratio, and disputing any errors on your credit report. By taking steps to boost your credit score, you can increase your chances of being approved for catalogues.

Alternative Financing Options

If you’re still having trouble securing catalogues with bad credit, there are alternative financing options to consider. Payday loans, installment loans, or secured credit cards may be viable alternatives for those with poor credit. These options can help you access the funds you need while working on rebuilding your credit.

Conclusion

Despite the challenges of bad credit, it is possible to secure catalogues in the UK with the right tactics and strategies. By understanding how bad credit affects your applications, improving your credit score, and exploring alternative financing options, you can shop on credit even with a less-than-perfect credit history.

- Are there catalogues specifically for individuals with bad credit?

- What are some tips for improving my credit score?

- Are there alternative financing options for those with bad credit?

Frequently Asked Questions

Can I get a catalogue with bad credit in the UK?

Yes, there are catalogues specifically designed for individuals with bad credit in the UK. These catalogues offer options for those who may have been rejected by traditional catalogues due to poor credit history.

What are the requirements for securing a catalogue with bad credit?

Typically, the requirements for obtaining a catalogue with bad credit are minimal. You may need to provide basic personal information and have a regular source of income. Some catalogues may also require a small deposit to get started.

Will getting a catalogue with bad credit affect my credit score?

Generally, obtaining a catalogue designed for individuals with bad credit should not have a negative impact on your credit score. However, it is essential to make timely payments to avoid any potential issues.

Are there any limitations to what I can purchase with a catalogue for bad credit?

While some catalogues may have restrictions on certain high-value items, most catalogues for bad credit allow you to shop for a wide range of products, including clothing, electronics, and home goods.

How can I improve my credit score while using a catalogue for bad credit?

One way to improve your credit score while using a catalogue for bad credit is to make regular, on-time payments. By demonstrating responsible borrowing behavior, you can gradually improve your credit score over time.

What happens if I miss a payment on my catalogue for bad credit?

If you miss a payment on your catalogue for bad credit, you may incur additional fees or interest charges. It is essential to contact the catalogue provider immediately to discuss your options and prevent any further negative consequences.

Can I upgrade to a traditional catalogue once my credit improves?

Once your credit score improves, you may be eligible to upgrade to a traditional catalogue with more extensive product offerings and potentially better terms. Contact the catalogue provider to inquire about upgrading your account.

Is it worth getting a catalogue for bad credit in the UK?

For individuals looking to rebuild their credit or access shopping options despite a poor credit history, getting a catalogue for bad credit in the UK can be a beneficial solution. It allows you to shop for essentials while working towards improving your financial standing.

How can I find the best catalogue for bad credit in the UK?

To find the best catalogue for bad credit in the UK, consider comparing the terms, product offerings, and customer reviews of different providers. Look for catalogues that offer reasonable fees, flexible payment options, and a straightforward application process.

Are there any risks associated with using a catalogue for bad credit?

While using a catalogue for bad credit can be a helpful tool for rebuilding your credit, it is essential to manage your finances responsibly to avoid accumulating debt. Make sure to read the terms and conditions carefully before applying for a catalogue to understand any potential risks.

Final Thoughts

Securing catalogues easily despite bad credit in the UK can be a practical solution for individuals facing credit challenges. By choosing the right catalogue designed for individuals with poor credit, you can access shopping options while working towards improving your financial situation.

Remember to use catalogues for bad credit responsibly, make timely payments, and keep track of your spending to avoid any potential negative consequences. With careful management, obtaining a catalogue with bad credit can help you rebuild your credit score and regain financial stability.